After around three successive rates slices as the September, the brand new Given is becoming inside a great “hold off and discover” function. You will need to remember that any possible reduction of production would not connect with your Video game up until they matures. In case your price is currently secured within the, you might be shielded from people future rates slices for the name from your current Cd. For those trying to safe a new Video game, today would be a good opportunity to protected a top produce before the Provided’s stance probably pushes rates straight down will be economic and you will rising cost of living investigation service you to circulate. Since the 2025 techniques, Puerto Rico’s focus on advancement, entry to, and you can sustainability positions they to weather economic concerns and you may continue broadening. Which have ascending demand, broadening rental locations, and you will energetic sale procedures, Puerto Rico is actually proving you to eden isn’t only a destination – it’s a sensation waiting to be discovered.

Newest Ripoff Hyip Programs

Constructive change to the brand new Government Reserve’s supervision and controls must be powerful and mirror not just the factors one proved pivotal to own SVBFG and also a wider set of potential circumstances one to could have not yet materialized and could end up being similarly consequential. This is especially true inside an environment in this way one which have fast economic and know-how, battle out of the brand new economic entrants, macroeconomic suspicion, faster monetary streams, and you will shorter interaction due to social network, all of which render an uncertain mix of dangers and you will possibilities to the banking system. An extensive evaluation from alter away from EGRRCPA, the brand new 2019 tailoring laws, and relevant rulemakings demonstrate that they combined to help make a weakened regulating construction to possess a company such as SVBFG. Then, the new enough time change periods provided with the rules one to performed use next put off the fresh utilization of criteria, for example stress research, which can has resulted in the newest resiliency of your own business. Which report examines the newest multiple points one to lead to the brand new incapacity from SVBFG and ratings the newest role of your own Federal Set aside, which had been an important government manager to the carrying team and you may the financial institution.

- Coca-Soda firmly believes the newest Irs as well as the Taxation Courtroom misinterpreted and you may misapplied the fresh relevant regulations mixed up in case and will vigorously defend the condition to your attention.

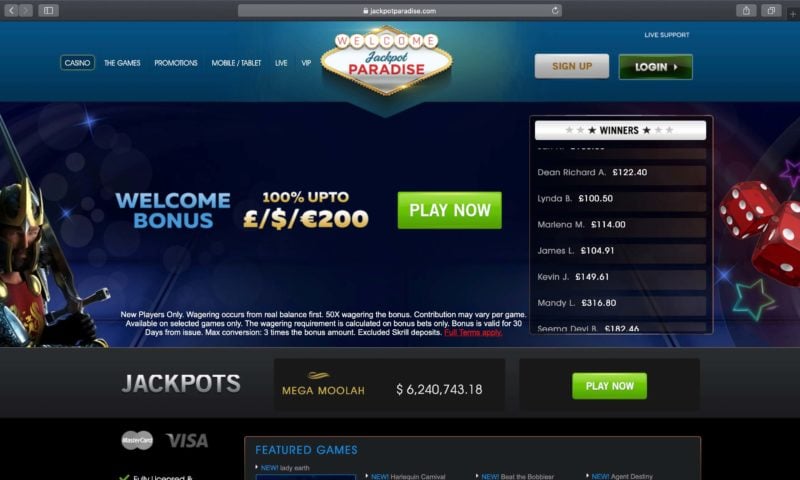

- Luckily, specific web based casinos has lower lowest dumps of 1 dollar, and they will leave you delicious incentives to experience with an increase of.

- This service membership World Company could possibly get willingly withdraw on the SITCA system for any reason by providing an electronic digital notice from withdrawal in order to the brand new Irs in the mode recommended because of the Internal revenue service.

- The new FDIC quotes your cost to the DIF out of solving SVB becoming $20 billion.

- A term put is actually a savings merchandise that will bring a fixed interest to own an appartment several months, ranging from 1 month in order to 5 years.

- To start with, make an effort to allow the lender 29 weeks notice and you can secondly you will likely be required to spend an early on withdrawal fee.

Part cuatro. Standards To own SITCA Candidates

Puerto Rico’s rooms market is enduring, backed by a persuasive combination of social interest, modern luxury, and you will sustainability. Having $1.7 billion inside accommodations money and six.7 million place nights reserved thus far this current year, the newest area has securely centered itself while the a leading travel appeal. Puerto Rico’s hotels surroundings try in the process of a conversion process, which have small-name renting to be a cornerstone of your field. November alone watched 229,100000 arranged place evening, representing a 17% boost across the earlier seasons. The year-to-time rooms cash totaled $step 1.7 billion, highlighting a keen 8% improve more 2022 and you may an astounding 104% growth than the pre-pandemic 2019 numbers. While you are resort request remained regular (-0.3%), Puerto Rico’s hotel market provides was able funds popularity because of wise costs tips.

Since the term suggests, a six-month name put allows you to purchase your finances for six months. The cash you dedicate can be your deposit, plus the amount of time you retain they spent which have a great bank, borrowing from the bank connection otherwise strengthening area ‘s the identity. A short-name deposit could help figure out how your lifestyle will get become affected by life instead of direct access to your savings. Towards the end of one’s half a year, you’ll know if your’re willing to invest your bank account for a longer time out of day. If you would like usage of their financing before maturity day of your own name put, you can break the fresh account. First, try to provide the bank 30 days notice and you can furthermore you’ll likely be asked to pay an early on withdrawal fee.

They’re federally covered for approximately $250,000 and offer a comfort zone to place your money when you are earning attention. On the March 20, the newest FDIC established it would offer the new putting in a bid process to own SV Connection Financial.35 find out this here When you’re there’s ample interest out of several events, the fresh FDIC determined it expected more hours to explore all of the alternatives so you can optimize worth and achieve the maximum outcome. The brand new FDIC and revealed it might allow it to be parties to submit independent offers to possess SV Bridge Bank and its part Silicone Area Private Financial.

Daily Computer game rates trend

For example interest will likely be paid off to the fresh renter every year while the provided in this clause, given, although not, one to in the event the the newest tenancy is ended before anniversary go out of one’s tenancy, the new occupant will discovered all accrued interest within this thirty day period of such as cancellation. Such interest might be outside the claims of these lessor, but since the provided for in this point. After yearly of a great tenancy, including lessor will provide or publish on the tenant from just who a security put might have been acquired an announcement and this will mean title and you can target of your own lender in which the shelter put might have been placed, the level of the newest deposit, the brand new membership count, plus the number of focus payable because of the such as lessor for the occupant.

As opposed to many other borrowing from the bank unions and you may financial institutions, CommunityWide won’t automatically replenish their certification membership abreast of maturity. Rather, you might want to renew they for the next label or even deposit the principal and interest to the other account during the CommunityWide otherwise another establishment. As soon as your Video game matures, Quontic Financial will bring an excellent 10-date sophistication period so you can withdraw their financing. The first withdrawal penalty selections from 90 so you can 540 days of attention, with regards to the term length. The bank brings a notification as much as thirty day period through to the Video game develops, from which day you could want to withdraw your financing, automatically replenish their Video game or roll-over the finance to a additional Video game.

Financial institutions will normally also require one become at least 18 yrs old to open a phrase put. When you’re less than 18, it would be it is possible to to open up a mutual membership having a parent otherwise guardian. To have an entire report on the distinctions, here are some the checking account vs label put publication. If you are considering an expression deposit otherwise a family savings, it’s beneficial to compare the two hand and hand.

Inside websites financial, you can place recommendations to incorporate/withdraw in the sophistication months, renew for the very same name or close the phrase deposit and you will transfer balance to a connected Bank Australia bank account. Repaired identity places provide an ensured rate out of get back on the currency to the lifetime of a financial investment. Also they are the lowest fix alternative so they really be a little more ‘set and you can forget’ than offers membership, which are far more flexible with withdrawals but wanted fulfilling added bonus criteria in order to get the benefit price. You can discover much more about the primary differences when considering term deposits or other savings profile.

Let’s go back to the person settlement value of these types of circumstances because the the sufferers features a keen need for claim value. Jury verdicts and claimed payment quantity in other tinnitus or reading losses instances strongly recommend the average personal settlement settlement from $fifty,100 in order to $three hundred,100000 inside the payment. Of many pros which e mail us wonder if your 3M circumstances are legitimate or if perhaps this can be particular ripoff.

Books, News and Specialist Information

Across the sunday, liquidity risk during the financial rose to help you a critical level because the detachment requests mounted, along with uncertainties on the meeting the individuals needs, and possibly anyone else inside the light of the high level of uninsured deposits, raised doubts in regards to the lender’s went on viability. Unlike SVB, which catered nearly only to venture capital companies, and you can Silvergate Bank, that was nearly entirely recognized for delivering functions to digital advantage organizations, Trademark Bank are a professional financial with lots of business outlines. Including, of their up to $74 billion as a whole money at the time of year-prevent 2022, just as much as $33 billion were within the commercial a home profile, around $19.5 billion from which consisted of multifamily a house. Signature Financial in addition to got a great $34 billion commercial and you will industrial loan portfolio; $28 billion ones had been financing produced from Money Financial Division, and therefore offered fund in order to personal collateral businesses and their standard partners. As opposed to SVB, and this displayed decline in complete securities portfolio from 104 % to full financing, Trademark Bank’s amount of depreciation is actually as much as 30 percent.

The fresh sanctioned solicitors, Kimberly Branscome and you will Jay Bhimani of Dechert LLP, presumably violated the brand new courtroom’s tips on the to present a piece of facts while in the closing objections. The fresh Eleventh Routine Courtroom governed you to definitely Legal Rodgers did not offer the necessary find prior to towering sanctions and you can don’t show that the fresh solicitors got acted in the bad faith. The fresh legal can still approve these solicitors, she only needs to explore a different basic inside issuing their abuse.

Section 467.—Particular Costs on the Entry to Property otherwise Functions

The newest regulatory limitation reduces it is possible to draw-to-business losings even though a money is compelled to offer bonds ahead of its readiness to fulfill the fresh exchangeability requires of the fund’s shareholder base. This is important to help you economic stability as the a fund that have a lot fewer liquid assets can be smaller furnished to help you prize high redemption requests in the locations where liquidity is rigid instead entering a flame sale out of bonds. Michael Hershfield ‘s the creator and you will President out of Accrue Discounts, a pals helping top stores to produce devoted FDIC-covered purses for their people — operating purchase, loyalty, and you will recite to buy.