Articles

For individuals who very own leasing assets, provide oneself a boundary facing these outcomes. Income-generating features makes rising cost of living work in the like. Owners improve book through the years inside alignment on the business consult (and you may courtroom limitations, obviously). Consult all of our financial professionals for additional info on all of our hard money mortgage options.

A lot more Chicagoans speak out up against iFLIP Chicago after the first NBC 5 Reacts report

Chicago provides a diverse savings built on several different monetary pillars–such as, however, would be the dining advancement, design, and you will instructional sources of money. The fresh solid economy produces Chicago a great location to secure an enthusiastic investment property, specifically for people worried about the long term. Let’s look at a number of the number 1 monetary source to possess Chicago’s GDP. In terms of to buy property in the city of Chicago, understanding the nuances of your a home procedure is key. One to vital aspect you to may be worth your attention is earnest money. That it initial deposit not simply shows their commitment to the transaction, but it also takes on a crucial role on the settlement and you will securing of one’s dream family.

Potential tenants generate losses to rental cons

Chicago’s real estate market is an excellent location to invest to possess numerous reasons, referring to real both for knowledgeable and you will newbie traders. For just one, the brand new communities inside Chicago are so diverse, so you’ll also have a wide range to choose from. Per people features its own interest, and you will according to growing manner, searching on the an area you to appears very effective. Inside 2024, at the least five Chicago characteristics (as well as 70 W. Madison) traded for over 50 million.

In regards to the Business

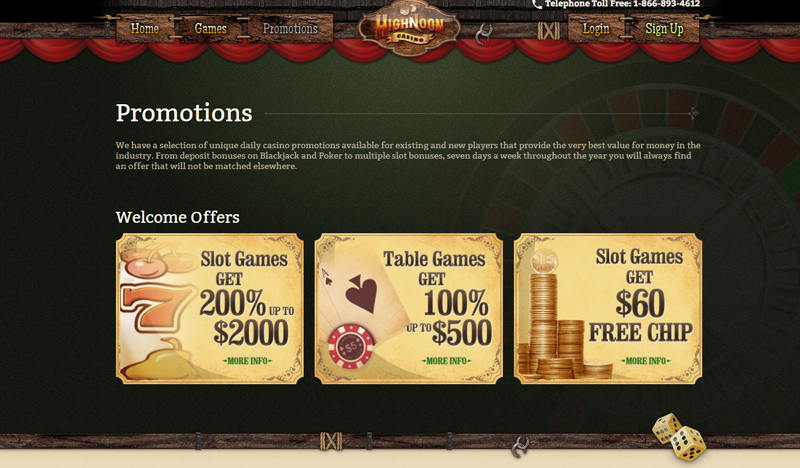

To make certain the earnest cash is really-secure, it’s important to are contingencies on your get arrangement. Popular contingencies tend to be financing, review, and assessment. These conditions offer you a leave means when the unexpected items occur, letting you hold your serious money in the https://happy-gambler.com/russia-casino/ event you have to disappear regarding the bargain. This is one other reason as to why it’s best if you work with an informed agent, to make sure that your passions try secure through the our home to shop for techniques. For as little as five hundred, traders can obtain to your DiversyFund Progress REIT and supplement the funding portfolios with commercial a house assets. Unlike a property stocks, REITs invest in direct a home and own, work otherwise fund earnings-producing functions.

Depending greatly on the property taxation since the reason behind financing societal universities merely means monetary inequity to your instructional inequity. A lender and you will/or label team will you want your own insurance documents. I’ve become during the a lot of closings in which the bank try going to obtain the insurance records however, did not. People should be aware of whether or not they try using for their insurance rates in advance or during the closing table.

Look and pick a reliable Hard Money lender.

Let’s view particular total understanding to your serious currency, to be able to navigate which very important step of the home to find processes with certainty. Chicago, known as the newest “Windy Urban area,” is home to on the 9.forty five million someone, so it is the 3rd premier city in the united states. They provides an enormous job market, iconic architecture, rich society and record, and deep-bowl pizzas. It also goes wrong with get one of the most extremely affordable real home locations amongst higher metropolitan areas in the nation, nonetheless it’s only a few rosy. A house transformation inside the Chicago nonetheless service a working boost/flip market. We would like to directly screen the average weeks in the business since when you’re flipping functions, here is the better indicator from just how long it will take one to promote while the property is accomplished.

Through to conclusion of that second stage, you create a final earnest currency percentage. Once more, there is absolutely no place amount, however, buyers usually set out between 3-10percent of the property’s sales rate. The only drawback for these given investing in Chicago services is actually the fee. It counterbalance because of the 2400 dollar 30 days average local rental price. You happen to be able to get an economy throughout these possible Chicago funding features. Such as, the typical household sits in the market to have four or maybe more weeks.

Should you Spend money on Chicago Money Characteristics?

Rogers Playground is also one of the most affordable parts within the the town; that’s uncommon given exactly how close it is for the shore away from Lake Michigan. Furthermore, they can access of a lot progressive facilities in the the downtown area Evanston. The fresh local rental marketplace is strengthened because of the exposure away from Loyola College.

Areas and other amenities define as to the reasons Niche.com gave the bedroom a b- to own family members. Just in case you want it Chicago investment functions, the clear presence of the fresh University out of Illinois during the Chicago is actually a good point in their favor. Rendering it a member of family package in the event you need to spend money on Chicago financing services. While it is found ten kilometers out of downtown, the new commute to Chicago’s main company section is fast with lots of possibilities. Public transit is actually comprehensive which have use of several coach and you will rail contours. You can see just how actually residents just who hung to its functions benefited since their financing liked for the comp rates.

- Other individuals who have scooped right up Chicago organizations to have bargain-cellar cost in past times several weeks said the newest time and you can standards are ready to own workplace sales this current year.

- Typically, belongings inside Chicago sell once 59 weeks in the market compared to 36 months a year ago.

- As for the work field, Chicago houses the new headquarters of numerous biggest organizations, in addition to beasts such McDonald’s, Walgreens, United Air companies, and you will Kraft-Heinz.

- “Dad felt in the Garvey’s content,” claims Rogers, who was simply given an enthusiastic African tribal term to help you draw his father’s commitment to the path.

Prior to plunge on the means of taking financing out of a good hard currency loan providers Chicago, it’s important to comprehend the concepts of tough money financing. Instead of antique loans from banks otherwise borrowing unions, hard currency finance are typically available with personal someone or organizations. These types of money is actually secure because of the a property and therefore are have a tendency to utilized because of the borrowers just who may not be eligible for antique funding due to points such as less than perfect credit or bizarre assets brands. Hard money fund routinely have high rates and you may shorter installment terms versus old-fashioned fund, however they offer fast access so you can money for real house opportunities and other monetary demands. Complete, hard money credit are an invaluable money for real estate investors and you will money spent owners in the Chicago who require quick access so you can financing and you will take pleasure in the flexibility from hard money money. When compared to old-fashioned banks, difficult money lenders offer an excellent speedier app process, shorter strict standards, and economic options designed to your means from regional investors.

- Which have financial costs near historical lows, the fresh Chicago housing market is popular up and both buyers and you will suppliers will get reasonable sales.

- Although an amateur investor, Chicago’s varied neighborhoods have too much to render to you inside regards to potential and you will earnings.

- Sandra Cleveland, such as, is a southwestern-top lady whose husband and you can boy had thus fired up over the woman pasta-sauce recipe she figured she’d go into team offering it.

- Since the one thing stand, all the a house transfers in the city is actually taxed during the a good price out of step three.75 per 500 out of reviewed well worth.

Since March 2022, the brand new median house price regarding the Chicago First Urban Analytical Town is 310,100000, right up 5.1percent of March a year ago. Age Chicago PMSA has yet so you can revert on the pre-Covid accounts normally. Regarding the Chicago PMSA, the brand new March 2020 median sales speed are 260,100000 (inside 2020) and you may 290,000 (inside the 2022); the fresh equivalent profile for speed healing within the February 2022 are 107percent just after changes (119percent ahead of modifying).